How Good Is State Farm Roadside Assistance Reviews

Our thoughts on Country Farm insurance

State Farm is well-established throughout the United States — it is the largest motorcar insurance visitor in 33 states and the largest homeowners insurance company in 39 states.

State Farm provides customers with a wide range of offerings, including eolith accounts, loans, investments and numerous types of insurance, including motorcycle, boat, small business concern, life and health.

Those looking for a personalized feel with a local insurance agent are likely to notice just that with State Subcontract, as it has a network of over 19,000 agents. This is in stark contrast to another large insurers — specially Geico and Progressive — that have fewer defended agents.

State Farm is also a adept choice for those who prefer to manage their insurance policies online. It has received positive reviews for its mobile app, which allows customers to pay their bills, file claims and asking roadside assistance.

Bottom line: If y'all are looking for low rates and a one-end store for all of your insurance needs, you lot should consider Land Farm.

State Subcontract auto insurance

- Rates

- Discounts

- Coverages

State Farm motorcar insurance quotes

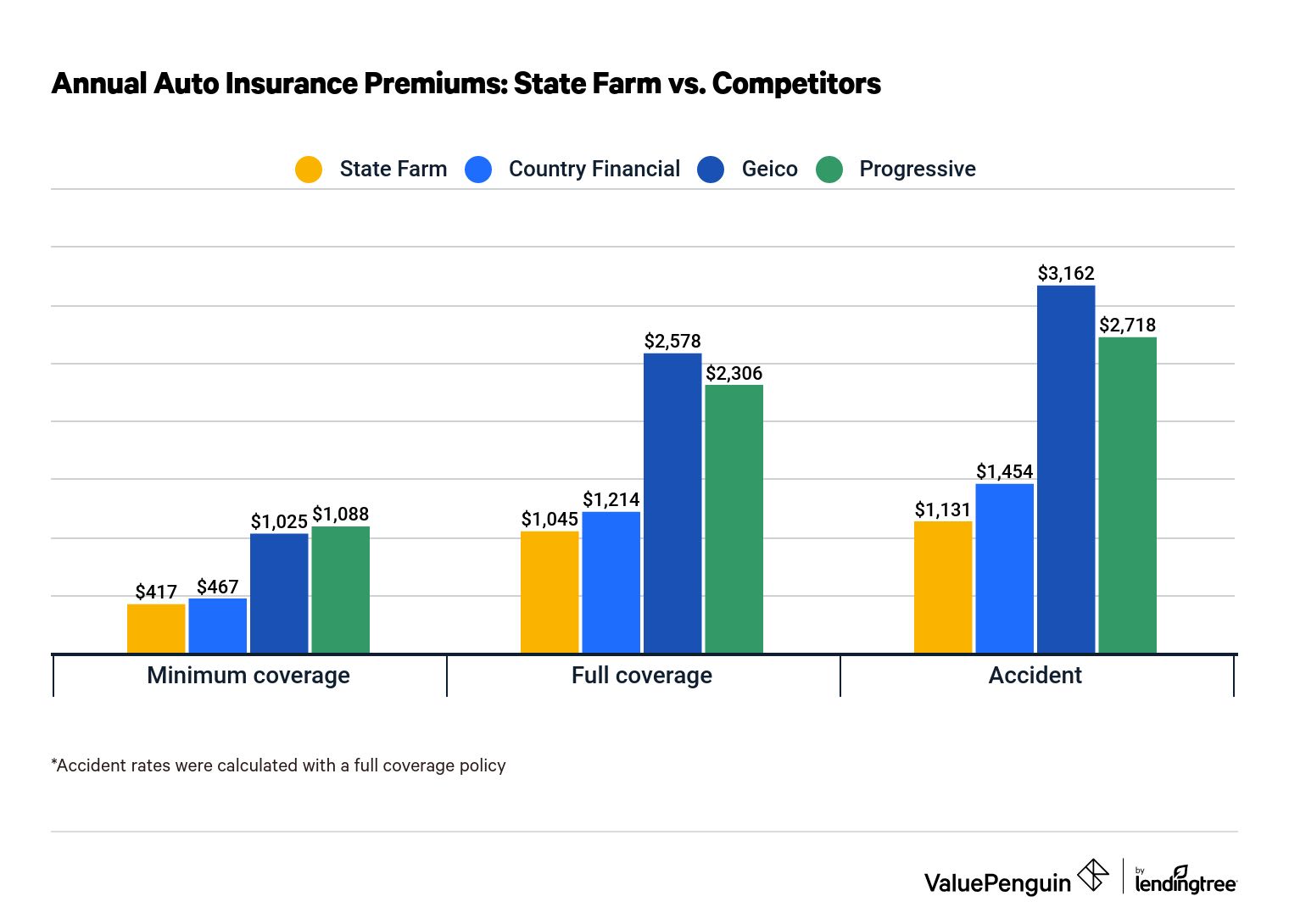

Country Subcontract's auto insurance rates are significantly less expensive than its competitors' rates — 44% cheaper than boilerplate — based on the quotes nosotros gathered. The company quoted $417 a year for minimum coverage and $1,045 for a full-coverage policy.

Find Cheap Auto Insurance Quotes in Your Surface area

| Visitor | Minimum coverage | Total coverage | Accident | |

|---|---|---|---|---|

| Country Subcontract | $417 | $1,045 | $1,131 | |

| Country Financial | $467 | $one,214 | $1,454 | |

| Geico | $1,025 | $2,578 | $3,162 | |

| Progressive | $1,088 | $2,306 | $2,718 |

Drivers who tin can take advantage of some of Country Farm's discounts may be able to lower their rates even further.

Rates may vary significantly by region and driver, so the all-time way to get the cheapest rates is to compare auto insurance quotes.

State Farm auto insurance discounts

Drivers looking for ways to reduce their automobile insurance rates volition find a wide diversity of discounts from Country Subcontract, including two discounts for prophylactic drivers that offer meaning benefits.

| Discount | How exercise you receive it? |

|---|---|

| Accident-free discount | Accept your vehicle continuously insured with Land Farm for at to the lowest degree iii years without having an at-fault accident |

| Defensive driving discount | Take a driver safe form |

| Practiced student discount | Take a GPA of 3.0 or higher |

| Package policies | Have a homeowners, renters, condo or life insurance policy from State Farm in improver to your automobile policy |

| Good commuter disbelieve | Go three years or more without an at-fault accident or moving violation |

Evidence All Rows

Highlighted discount: Steer Clear driver program

This program by State Subcontract is designed for those under 25 years quondam to castor up on their driver pedagogy. Steer Clear includes grade training, practise driving and mentorship. Your State Farm agent can aid you navigate the program, which can exist completed online or on your mobile app. This program is available in all states except California, Hawaii, Massachusetts, Northward Carolina and Rhode Island.

Highlighted discount: Drive Safe & Save

Eligible drivers who enroll in the Drive Prophylactic & Save program receive an automated discount on their auto insurance rates just for signing upwards. This program uses information from your vehicle's OnStar system or the Drive Safe & Save mobile app to runway your driving habits. Country Subcontract will utilise this data at each policy renewal to determine how much you can salvage — which could be upwardly to 50%.

State Subcontract auto insurance coverages

State Farm offers customers all of the standard car insurance coverages, including liability insurance, uninsured/underinsured motorist coverage, collision and comprehensive insurance, and personal injury protection.

It as well offers a few other valuable policy add-ons, such every bit rental car and travel expenses coverage and rideshare insurance.

| Coverage | Description | Is it required? |

|---|---|---|

| Liability insurance | Covers the cost of repairs or medical care if you cause damage or injury to some other driver | Yes, but each country has different required limits |

| Uninsured and underinsured motorist | Covers damage if the at-fault driver can't pay | Required in some states |

| Collision | Covers damage to your automobile after a standoff, no matter who was at fault | Could be required if you lot have a charter or loan on your car |

| Comprehensive | Covers damage to your motorcar that isn't caused past a standoff | Could be required if you accept a charter or loan on your machine |

| Personal injury protection (PIP) | Covers medical expenses for you and your passengers, no affair who is at fault in an blow | Required in some states |

| Emergency road service coverage | Covers towing, locksmith labor and delivery of gas, oil, a new bombardment or a change of tire if your car breaks down | No |

| Rideshare driver insurance | Provides coverage while you drive for a rideshare app | Could be required if you have a lease or loan on your car |

| Rental machine and travel expenses coverage | Covers the cost of a rental car while yours is being repaired, and certain expenses if your car breaks downwards while yous're traveling | No |

Highlighted benefit: Rental motorcar and travel expenses

While rental automobile insurance is a pretty standard optional coverage amongst insurers, State Farm'southward coverage goes above and across by roofing lodging, transportation and meals if your vehicle is disabled while y'all're on the road. This coverage pays for travel expenses of upward to $500 per incident. To take advantage of travel expenses coverage, your car has to exist undrivable as a event of an incident that falls under your comprehensive or collision insurance.

Highlighted do good: Rideshare insurance

If you drive for Uber or Lyft (either part fourth dimension or full fourth dimension), then you need to purchase a separate rideshare insurance policy. State Farm offers rideshare insurance that extends the coverages from your personal car insurance policy to comprehend yous while you're working. Typically, adding rideshare coverage to your insurance policy raises your premium past 15% to 20%.

Country Farm classic machine coverage

Country Farm offers coverage for classic cars and in 2022 partnered with Hagerty to offering a coverage called State Farm Classic+. State Farm had previously offered archetype motorcar coverage, simply Hagerty is an industry leader in that area. The companies expect to encompass every state by 2023.

Classic car coverage is usually built around agreed value insurance in which the owner and visitor agree on a fixed value for the vehicle. Archetype cars are more hard to repair, and so it often makes sense to accept an insurer with specialized knowledge.

State Farm considers a car classic if it is between 10 and 24 years old and has historic interest — for example, a hot rod or muscle motorcar.

Country Farm home insurance

- Rates

- Coverages

- Discounts

State Subcontract homeowners insurance quote comparing

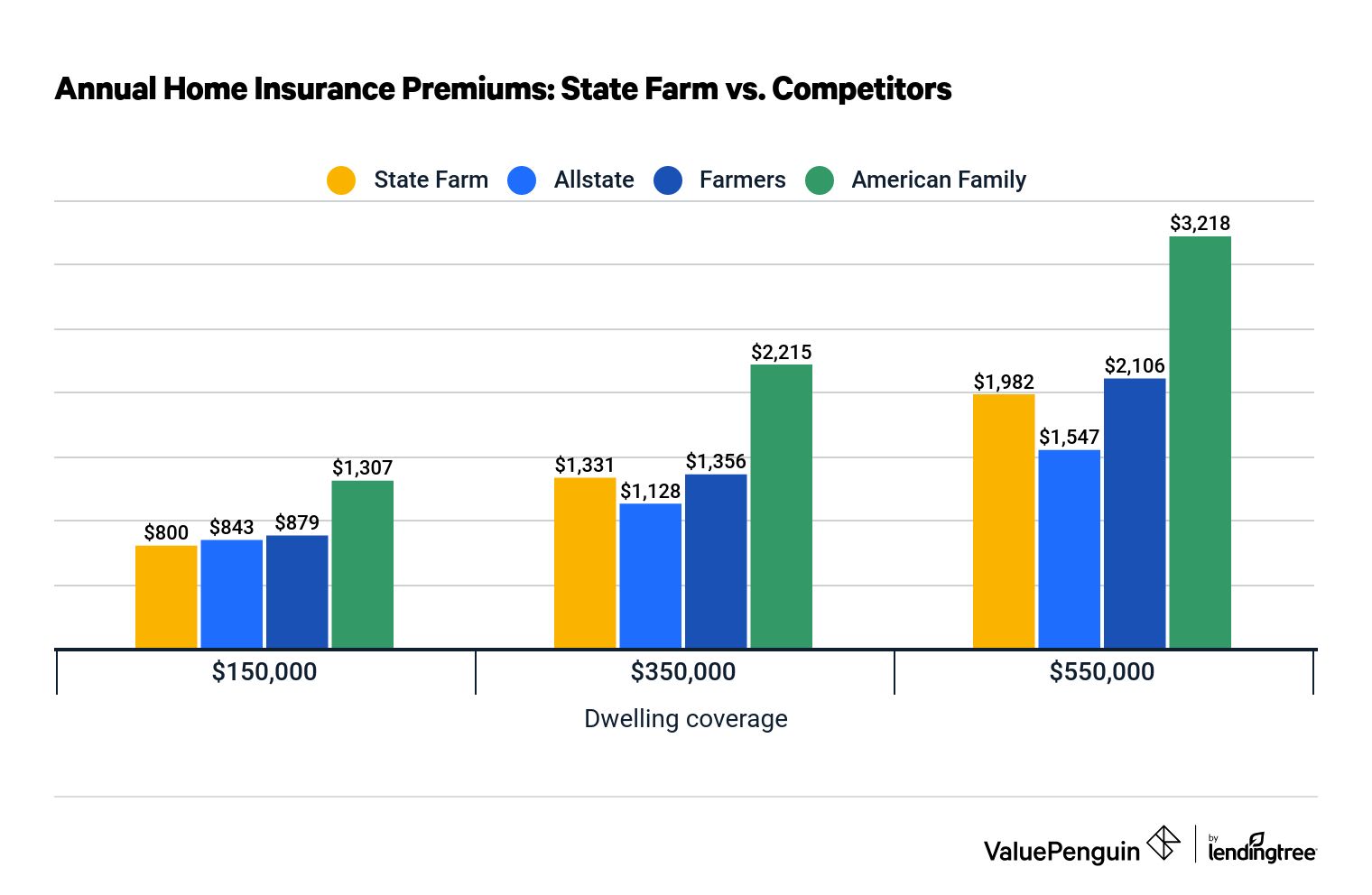

State Farm'due south homeowners insurance rates are very competitive — sixteen% below average across several different dwelling coverage amounts.

Find Cheap Homeowners Insurance Quotes in Your Area

| Dwelling amount | $150,000 | $350,000 | $550,000 |

|---|---|---|---|

| Land Farm | $800 | $1,331 | $1,982 |

| Allstate | $843 | $1,128 | $1,547 |

| Farmers | $879 | $ane,356 | $2,106 |

| American Family unit | $1,307 | $2,215 | $3,218 |

Insurance rates may vary widely by region and property. We recommend gathering multiple quotes to ensure you get the all-time rate.

Country Farm homeowners insurance coverage

Land Farm offers all the homeowners insurance coverages you'd wait from a national insurer, such as personal liability, medical payments and dwelling coverages. The visitor as well offers the following optional coverages:

- Coverage for water impairment because of a sewer, drain or sump pump backup.

- Identity restoration services and reimbursement afterwards identity theft, reimbursement of data recovery costs later on a cyber attack, and professional aid and reimbursement if you're a victim of cyber extortion.

- Home systems protection pays to repair or replace abode equipment damaged by accidental mechanical or electrical breakdown.

- Service line coverage covers the cost to repair or replace homeowner-endemic outside underground h2o and sewer piping, electric service lines and information lines that fail or are accidentally broken.

Highlighted benefit: Premier Service Program

The Premier Service Program is an optional service that puts policyholders in affect with participating contractors that tin can provide roof and floor repairs and replacement, h2o removal services and more. The repairs are guaranteed for up to five years for a covered loss. This programme is not yet available in all locations.

Country Farm habitation insurance discounts

State Farm provides policyholders a few ways to save on homeowners insurance costs, which are adequately standard:

- Abode security disbelieve

- Multi policy bundling discount

- Damage-resistant covering fabric discount

Country Farm renters insurance

- Rates

- Coverages

State Farm renters insurance cost

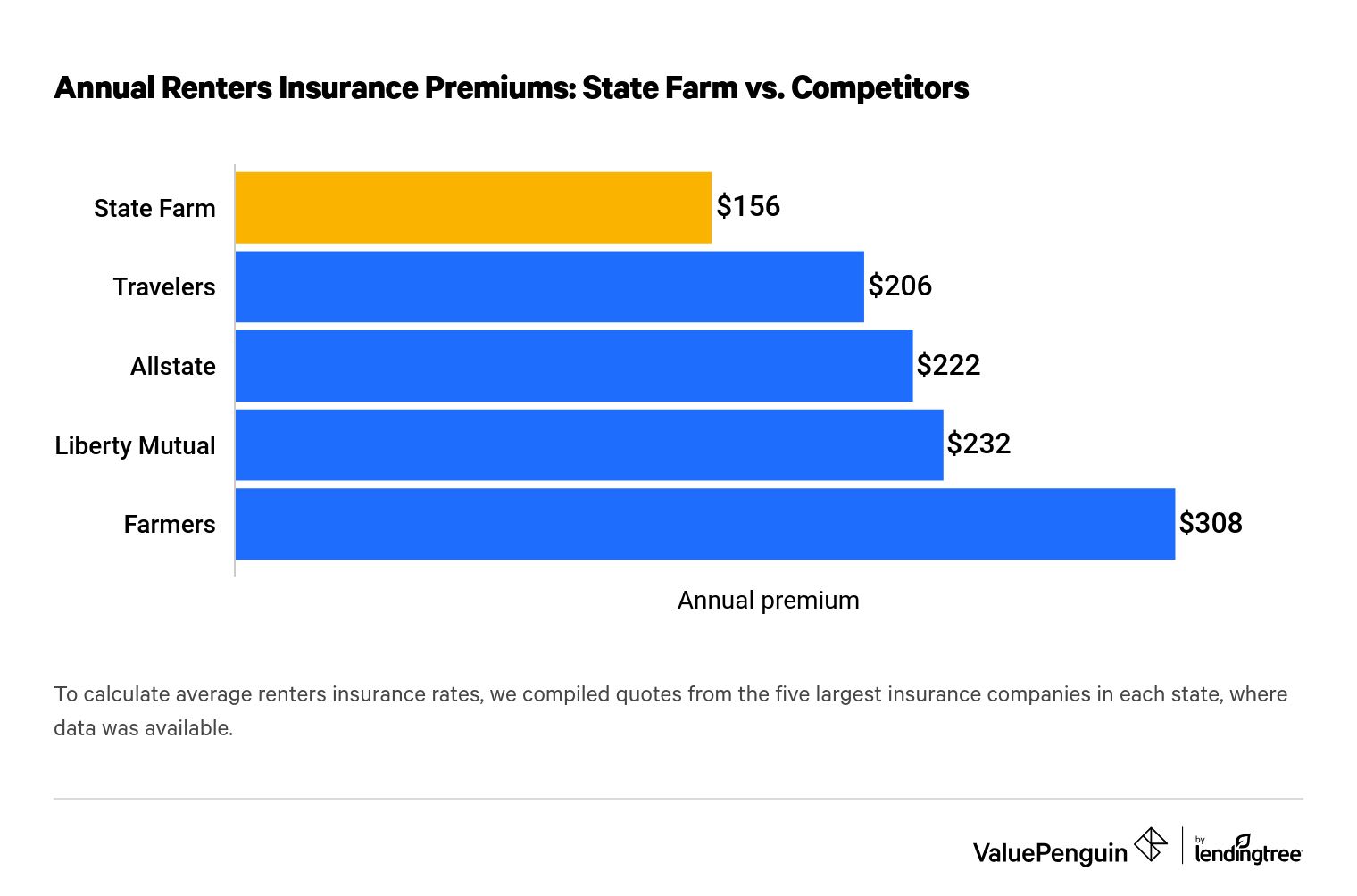

Land Farm has the cheapest renters insurance rates amidst major insurers — 30% below average. Getting an online quote for renters insurance from Land Farm is easy and quick — we were able to get together several quotes in under 10 minutes.

Notice Cheap Renters Insurance Quotes in Your Surface area

Country Farm renters insurance coverage

Country Farm renters insurance provides all of the standard coverage options that y'all would look from a major insurer.

| Coverage | Clarification | Included or optional? |

|---|---|---|

| Personal property | Provides coverage against damage to your belongings based on your chosen coverage amount. | Included |

| Personal liability | If someone is injured on your property or experiences property impairment and holds y'all responsible, your personal liability coverage tin pay for litigation and repairs, even if you are at fault. | Included |

| Medical payments to others | Covers the medical bills of guests if they're injured on your property. | Included |

| Loss of utilise | Provides reimbursement for living expenses if your home is temporarily uninhabitable. | Included |

| Identity restoration | Provides protection if you're a victim of identity theft or cyber extortion. | Optional |

| Earthquake harm | Covers damage to your belongings in the event of an earthquake. | Optional |

| Boosted business organization property and incidental liability | Provides coverage for owners of small to medium-sized businesses. | Optional |

Highlighted do good: Identity restoration

For $25 per twelvemonth, State Subcontract'due south identity restoration endorsement comes with instance management and expense reimbursement in case your personal information is stolen. If thieves hijack your identity and use it to commit theft or fraud, State Farm may reimburse you for up to $25,000 to encompass the costs associated with recovering your identity and settling any litigation. Y'all are also covered up to $15,000 if you're a victim of ransomware. Additionally, you'll receive credit monitoring to reduce the chances your information gets compromised.

Land Farm insurance ratings and client service reviews

Customers can expect amend-than-boilerplate customer service with Land Farm. The company received high scores from J.D. Ability for overall client satisfaction, claims satisfaction and shopping feel.

According to the NAIC Complaint Index, State Subcontract receives fewer complaints than a typical insurer of its size.

The National Association of Insurance Commissioners (NAIC) Complaint Index measures the number of complaints a company receives in relation to the size of its client base. Country Farm scored 0.74 for habitation and renters insurance and 0.97 for auto insurance — below the i.0 average.

State Farm received an A++ fiscal forcefulness rating from A.Thousand. Best, which is the highest rating an insurer tin can receive.

A high rating means that customers do non need to worry most whether their insurance company will have enough funds to pay claims. Note that this does not mean that Country Farm is more probable to approve an insurance claim, only that it has the funds necessary to pay settlements.

How to file a claim with Land Subcontract

In that location are multiple ways to file an insurance claim with State Subcontract.

Country Farm's online claims process is streamlined and informative. Policyholders tin file motorcar, home, renters, health, life and business claims on the company'due south website or via its app. The online claims procedure takes nigh x minutes to complete, subsequently which you can easily proceed rail of your merits.

Customers tin can also file claims over the phone. If you work with an agent, you can file a merits through your local office during business hours. Yous can too call the numbers below.

- For motorcar, home and holding claims, telephone call (800) 732-5246.

- For automobile glass claims, telephone call (888) 624-4410.

- For emergency roadside assistance, call (877) 627-5757.

- To make a payment, call (800) 440-0998.

Frequently asked questions

Is Land Farm a good insurance company?

State Farm is a good insurance company — we gave it an overall rating of 4.5/5. The company has cheap auto and home insurance rates and the all-time renters insurance rates that nosotros found. It also earned higher up-average customer service and fiscal forcefulness scores.

Does State Farm offering health insurance?

Land Farm offers health insurance along with a wide range of insurance products, including life, disability, liability, small-scale business and pet medical insurance.

What does State Farm total-coverage auto insurance encompass?

Full-coverage auto insurance from Land Farm includes:

- Comprehensive coverage

- Collision coverage

- Liability coverage

- Uninsured/underinsured motorist coverage

- Medical payments coverage

The company also offers emergency roadside assistance, car rental and travel expenses coverage, and rideshare commuter coverage every bit optional add-ons.

How much is State Subcontract auto insurance?

We establish that the cost of State Farm car insurance is $417 a year for minimum coverage, $ane,045 for full coverage and $one,131 for drivers with an at-fault accident on their record. Car insurance rates vary based on historic period, vehicle type, location, driving history and other factors, so your quotes may differ.

Is Land Farm expensive?

Nosotros found that State Farm has very competitive insurance rates. Its auto insurance rates are 33% cheaper than its competitors, on average, and home insurance rates are 16% cheaper. Country Subcontract has the cheapest renters insurance rates we found — 30% less than other major insurers.

Where is State Farm bachelor?

State Farm has insurance customers nationwide — it is the largest provider of home and auto insurance in the land. However, it doesn't sell all types of insurance everywhere. For example, you tin can no longer buy Country Farm car insurance in Massachusetts.

Does State Farm offer gap insurance?

You cannot buy gap insurance from State Subcontract. However, drivers who have a Country Farm car loan are automatically enrolled in its Payoff Protector program. The company will cancel the remaining balance on your loan minus your insurance payout after your car is totalled, as long equally your loan is in skillful standing.

Methodology

To compare the toll of State Farm's machine, homeowners and renters insurance policies, we used sample profiles based on typical customers.

For our auto insurance review, nosotros compiled quotes for a 30-year-old male person living in Illinois and operating a 2015 Honda Borough EX, based on the following coverage levels:

| Coverage | Minimum coverage | Full coverage |

|---|---|---|

| Actual injury liability | $25,000/$l,000 | $50,000/$100,000 |

| Holding damage liability | $20,000 | $25,000 |

| Uninsured motorist bodily injury | $25,000/$50,000 | $50,000/$100,000 |

| Underinsured motorist bodily injury | not included | $50,000/$100/000 |

| Comprehensive deductible | non included | $500 |

| Collision deductible | not included | $500 |

For our homeowners insurance review, we collected quotes for $150,000, $350,000 and $550,000 of dwelling coverage. Our sample policyholder is a husband who lives in a house in Illinois built in 1977. He has been claims-free for five years and has an average credit score.

For our renters insurance reviewsouthward, nosotros compiled quotes from the five largest insurance companies in each land, where the information was available. Our sample renter is an unmarried 30-year-erstwhile male, with no pets or roommates, living in a multi-unit building, with the following limits:

| Coverage | Amount |

|---|---|

| Personal property | $30,000 |

| Personal liability | $100,000 |

| Medical | $1,000 |

| Deductible | $500 |

Home and auto insurance quotes used insurance rate data from Quadrant Data Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your ain quotes may differ.

Source: https://www.valuepenguin.com/state-farm-insurance-review

0 Response to "How Good Is State Farm Roadside Assistance Reviews"

ارسال یک نظر